Some Known Questions About Frost Pllc.

Wiki Article

The 10-Second Trick For Frost Pllc

Table of ContentsWhat Does Frost Pllc Mean?Rumored Buzz on Frost PllcThe 30-Second Trick For Frost Pllc6 Simple Techniques For Frost PllcFrost Pllc for Dummies

CPAs are among the most trusted occupations, and completely factor. Not only do CPAs bring an unequaled degree of knowledge, experience and education to the procedure of tax obligation planning and handling your cash, they are specifically trained to be independent and unbiased in their job. A certified public accountant will aid you shield your rate of interests, listen to and address your issues and, equally important, give you assurance.Hiring a local CPA firm can favorably affect your service's monetary health and wellness and success. A neighborhood CPA company can help minimize your business's tax burden while making sure conformity with all relevant tax legislations.

This development shows our dedication to making a favorable effect in the lives of our customers. When you function with CMP, you become part of our family members.

The Greatest Guide To Frost Pllc

Jenifer Ogzewalla I've functioned with CMP for a number of years now, and I've actually appreciated their experience and effectiveness. When bookkeeping, they function around my timetable, and do all they can to maintain connection of personnel on our audit.

Here are some key concerns to guide your decision: Inspect if the certified public accountant holds an active permit. This guarantees that they have passed the essential tests and satisfy high honest and expert requirements, and it shows that they have the qualifications to handle your monetary matters sensibly. Validate if the certified public accountant supplies solutions that line up with your organization demands.

Tiny businesses have special economic demands, and a Certified public accountant with relevant experience can offer more tailored recommendations. Ask concerning their experience in your sector or with companies of your dimension to guarantee they understand your specific challenges.

Clarify just how and when you can reach them, and if they supply routine updates or consultations. An easily accessible and receptive certified public accountant will be important for prompt decision-making and assistance. Employing a local certified public accountant company is more than simply outsourcing financial tasksit's a clever financial investment in your organization's future. At CMP, with workplaces in Salt Lake City, Logan, and St.

An Unbiased View of Frost Pllc

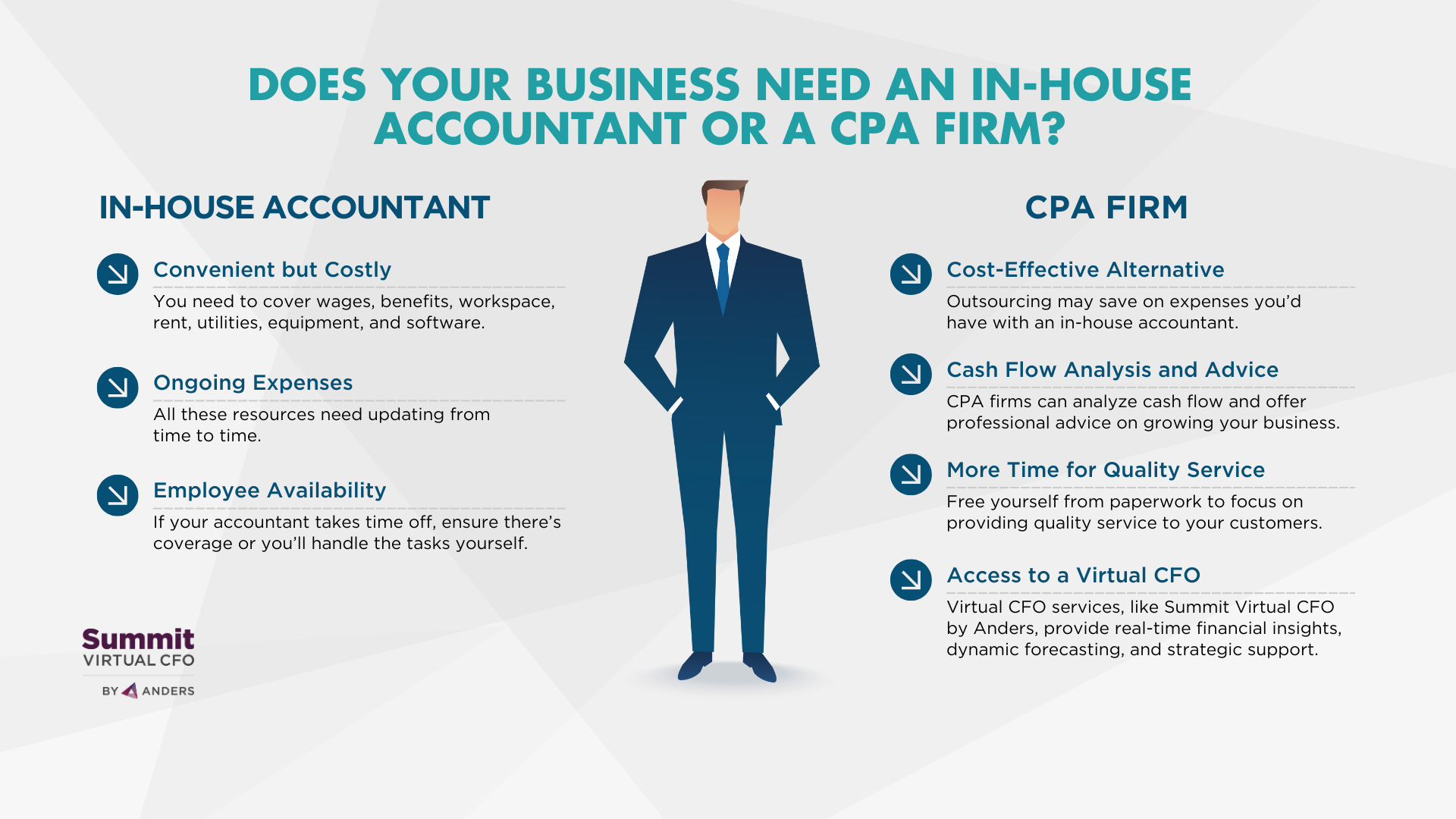

An accounting professional who has actually passed the CPA test can represent you before the IRS. Certified public accountants are certified, accounting professionals. CPAs might help themselves or as component of go a company, relying on the setup. The expense of tax obligation preparation might be reduced for independent experts, but their knowledge and ability may be much less.

The smart Trick of Frost Pllc That Nobody is Talking About

Handling this obligation can be a frustrating task, and doing glitch can cost you both monetarily and reputationally (Frost PLLC). Full-service certified public accountant firms recognize with filing demands to guarantee your business adhere to federal and state legislations, as well as those of banks, capitalists, and others. You might need to report extra income, which might need you to file a tax return for the initial time

group you can trust. Get in touch navigate to this site with us for additional information concerning our solutions. Do you comprehend the accountancy cycle and the actions included Check Out Your URL in guaranteeing proper economic oversight of your organization's monetary well-being? What is your business 's lawful structure? Sole proprietorships, C-corps, S firms and partnerships are exhausted in a different way. The even more complex your revenue sources, locations(interstate or global versus regional )and sector, the more you'll require a CPA. Certified public accountants have much more education and learning and undergo a strenuous certification procedure, so they set you back even more than a tax obligation preparer or accountant. On average, local business pay between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this expenditure may beout of reach. The months gross day, April 15, are the busiest time of year for Certified public accountants, followed by the months prior to completion of the year. You may need to wait to get your questions responded to, and your tax return can take longer to finish. There is a minimal variety of Certified public accountants to go about, so you might have a tough time finding one particularly if you've waited till the last min.

CPAs are the" huge guns "of the accountancy industry and usually don't deal with day-to-day audit jobs. Usually, these other kinds of accounting professionals have specializeds across locations where having a Certified public accountant permit isn't called for, such as monitoring accountancy, nonprofit bookkeeping, price accountancy, federal government accounting, or audit. As a result, making use of an accountancy services company is often a much much better value than working with a CPA firm to company your ongoing financial recurring effortsAdministration

Certified public accountants additionally have competence in creating and perfecting organizational policies and treatments and evaluation of the practical requirements of staffing models. A well-connected CPA can utilize their network to assist the organization in numerous critical and speaking with functions, efficiently connecting the company to the optimal prospect to satisfy their requirements. Next time you're looking to fill a board seat, take into consideration getting to out to a Certified public accountant that can bring worth to your organization in all the means listed above.

Report this wiki page